DraftKings: The Game Inside The Game

Draftkings is a digital sports entertainment and gaming company which provides consumers with daily fantasy, sports betting, and iGaming products. The company is also involved in the design and development of sports betting and casino gaming software primarily for traditional casino’s who are looking to kickstart their online gaming platforms.

Summary:

Best in-class vertically integrated product in the online daily fantasy sports and sports betting space, with over 12M users and continued product innovation

Large total addressable market, leading market position, and positive developments on the legal front

Solid revenue growth (27%), stable gross margins (43%), and increasing ARPMUP ($42 —> $63)

Stretched relative valuation, but strong earnings potential is encouraging

Product:

DraftKings offers products to both consumers and businesses, but their offerings to consumers are by far the most popular. With over 15 live sports and e-sports included, DraftKings is able to reach a wider audience and consistently engage the user, especially as many of those sports seasons overlap during the year. Below, I’ll breakdown all of their B2C and B2B products and how DraftKings drives innovation in both departments.

B2C:

We can group DraftKings B2C products into two main buckets, the Daily Fantasy product and the SportsBook product. Initial user engagement on both products is driven by individual state legislation, with the Daily Fantasy product legal in all but six states, compared to the SportsBook product which is only legal in 14 states.

Daily Fantasy:

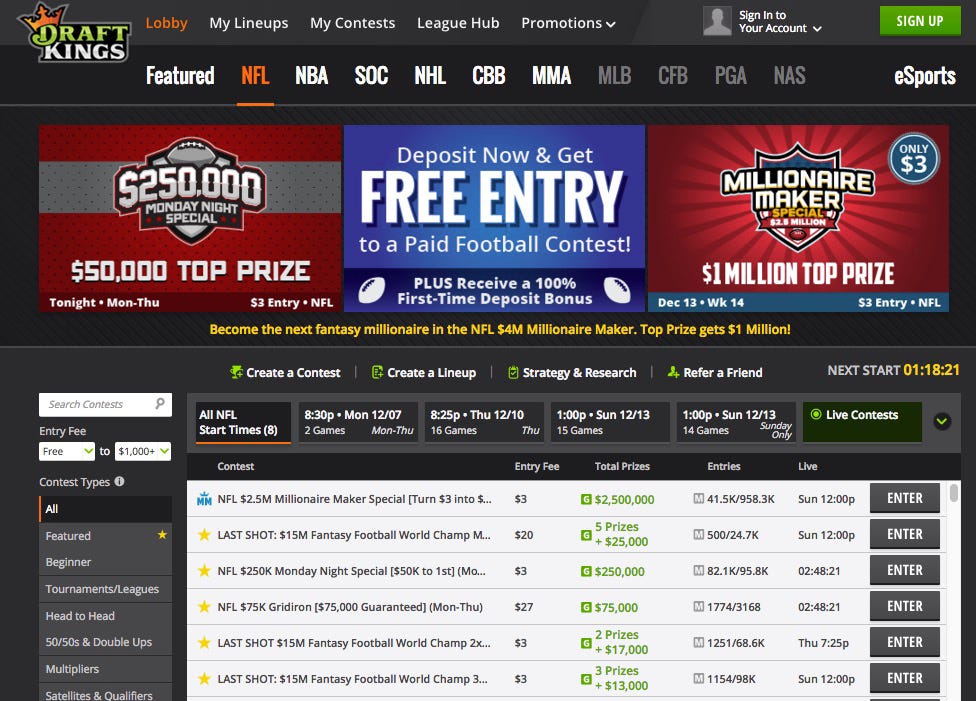

Source: DraftKings Website

The Daily Fantasy product is DraftKings core product offering, and allows users to enter into various free and paid contests to compete with each other. There are over seven contest types, as DraftKings first started with Head to Head contests before adding the 50/50s and Tournament contests to increase user engagement. The simplicity and ease with which users can filter and enter into contests which suit their needs provides the company with a key advantage over other DFS providers, although the quality of the interface is subjective in nature. With a plethora of ongoing sports, DraftKings isn’t overly reliant on any one sport to drive revenue, but their NFL contests are by far the most in demand, which we will take a further look at below.

Source: DraftKings Website

As illustrated above, once the user enters into a contest of their liking, they will have to build their own team of players within the $50,000 salary cap amount at the respective positions given. The user’s performance, or prize winnings, relative to other competitors will be based off of individual player performance. Another example of how DraftKings has continued to innovate is their new “Tiers” format, which allows the user to select pre-placed players across eight tiers. Ultimately, the company has a stable user base in their Daily Fantasy product, but they will have to keep employing innovative tactics to attract first time users and users off of other platforms.

SportsBook:

Source: DraftKings Website

The second B2C product is the SportsBook product, where the user can wager on the outcome of a player or a game with the given odds. Once again, the straightforwardness of the use case and promotions stand out, but accessibility is the main advantage DraftKings has over its competitors because the user doesn’t have to physically go to a casino to place bets, they can do so through their app or their website.

B2B:

Through the acquisition of SBTech earlier this year, DraftKings is able to provide physical sports book and casino gaming operators, such as Wynn, with the software and solutions to establish an online presence. The value of this product and service is greatly under-appreciated, especially as tailwinds in the form of social distancing and online penetration change the industry.

Business:

Revenue: DraftKings primarily makes money in both its B2C and B2B products through what is known as “rake”, or a scaled commission fee it charges users for entering into contests and placing bets. The rake is fixed and can vary anywhere from 5%-15% in DFS contests, but is all dependent on user’s wagers net of any payouts made on user winnings in the sports book and casino products. Revenue from the B2B segment is largely contract based, with contract revenue also tied to a percentage of the wagering revenue generated by the customer. It is evident DraftKings relies on volume to drive revenue, as any increase in rake would only result in lost customers.

Cost: A majority of the company’s costs are variable, such as platform costs, processing fees, and sales & marketing expenses. Although the former makes up a higher percentage of their costs currently, I expect the latter to significantly increase as the company looks to acquire more customers and expand its products worldwide.

DraftKings doesn’t have the most profitable business model, but as they continue to scale nationally, the increasing volume and decreasing customer acquisition costs should offer a path to profitability.

Industry & Market Opportunity:

Source: DraftKings Investor Presentation

Presently, the online sports betting and casino gaming industries remain largely under-penetrated globally. Only in the past two decades have we seen more internet/smartphone penetration and legalization of sports betting. Market share in both segments remains fragmented, and with the combined total addressable market projected to be north of $40B with a CAGR of 25% at its maturity in just the U.S., there is a lot of opportunity for growth. Also keep in mind these projections don’t fully take into account how some retail users may never return after transitioning to online gaming. Regulatory uncertainty remains DraftKings’s biggest hurdle and risk, so let’s take a look below at how the situation has unfolded in recent years.

Source: DraftKings Investor Presentation

With DraftKings looking to build its presence in the U.S. first, legal developments in the states are of primary interest. As states look for alternative revenue sources with the U.S. budget deficit at record highs, the online sports betting and iGaming stand to benefit the most. For example, New Jersey collected almost $36M in state revenue over the last one and a half year since they started allowing online betting and gaming. Imagine how much more revenue the state could earn as more people become aware of the legalization and start wagering. Even though it will take time for the U.S. and the world to fully legalize the two industries, there aren’t too many disincentives preventing them from doing so.

Competition:

Source: Proprietary Presentation

Competition in the sports betting and gambling industry is fierce, regardless of whether the company is predominantly operating online or on land. Although traditional land casinos such as MGM will always remain a threat to DraftKings because of their size, the industry’s gradual transition towards the online segment will force them to launch their own online products. An example is MGM’s recently launched online sports book BetMGM, which complements their physical location. In the future, expect considerable overlap and consolidation among the companies highlighted above in both the sports betting and gambling industries. It is clear market share in both the physical and online markets is up for grabs, which means DraftKings focus on product innovation and marketing to attract customers will be even more critical to its future success.

Back in 2017, DraftKings was all set to merge with its #1 competitor in the online sports betting and daily fantasy market in the U.S., FanDuel. The FTC eventually blocked the merger from occurring due to anti-trust concerns, and for good reason. Today, research analysts estimate the combined companies make up 81% of the total U.S. market. FanDuel is projected to have a 43% share relative to DraftKings 38%. Up until this past year, neither company did much to differentiate itself from the other, especially considering they both offer the same products. However, I believe DraftKings separated itself from FanDuel by improving its proprietary technology through the acquisition of SBTech, continually innovating across all of its products, and inking several partnerships with professional organizations and players which it later advertised heavily.

Financials/Valuation/Comparables:

Currently, DraftKings trades at a very rich 77x TTM revenues, largely due to a reduced sports calendar and continuous interruption as a result of the coronavirus. Although DraftKings saw strong quarterly sales amidst the pandemic, its strong growth rate took a hit. Similar trends were observed across the industry and all online gaming companies rebounded well as sports returned for the rest of 2020. Hence, it will be tough to compare 2020 financial information, and a majority of the focus will be on how these companies stack up against each other moving into a more “normal” 2021 calendar year.

At first glance, DraftKings 26x projected multiple for 2021 seems far more reasonable than its 2020 multiple, but not when compared to its absurd relative premium. Despite possessing the highest growth rate among its peers, illustrating DraftKings will grow into its high multiple over time, such a vast difference is concerning and unwarranted. A low gross margin percentage also doesn’t help the cause, but this will improve as the company saves on platform costs and extends partnerships. On the bright side, a direct comparison of these multiples is unfair to DraftKings because companies such as Flutter Entertainment (parent of FanDuel) and Penn National (owner of Barstool Sports) include other segments which don’t relate to DraftKings’s operations. To put into further perspective, in 3Q20, FanDuel and Barstool accounted for less than 12% and 5% of total Flutter and Penn sales respectively. The inclusion of traditional more developed casino players in the peer group is necessary because of their growing influence in the online gaming space, but from a valuation standpoint, a true comparison is too early to be made right now. As online sports gaming and betting becomes a larger part of the overall market, more segment specific information and a path to profitability will distinguish which companies are trading at attractive valuations. A recommendation for DraftKings purely based on current valuation is unattractive, as existing investors are more excited with the company’s growth potential.

Conclusion:

DraftKings is the only vertically integrated company in a fast growing online sports betting and gaming services industry. With its superior technology and management’s ability to recognize the importance of product innovation, it is starting to solidify itself as a market leader. It’s biggest risk remains regulatory oversight, but with three more states legalizing sports betting during the U.S. election, 25 out of 50 states now legally allow sports wagering.

Disclaimer: Integrated provides company specific information regarding public and private companies in addition to weekly market commentary as part of our blog and emails. Such information is for general informational purposes only and should not be construed as investment advice or other professional advice. The cartoons included in the blogs are cited from other sources and not under the ownership of Integrated.