Codoxo: Artificial Intelligence for Healthcare Fraud Management

Codoxo is an artificial intelligence assisted platform that accelerates the identification of fraud, waste, and abuse in the healthcare sector. The company was founded back in 2018 by Musheer Ahmed at the Georgia Institute of Technology to make the healthcare system more affordable and effective. After recently completing its Series A funding round this past year, Ahmed re-branded Codoxo from FraudScope and unveiled an array of new product offerings to power the company’s growth.

Summary:

Patented technology addresses a growing problem in the healthcare space with the increase in demand for healthcare and digitization

Holistic solutions approach encompassing all aspects of the healthcare billing and payments value chain

Leadership includes a mix of experience and youth across the technology and healthcare space

Opportunity for growth in an emerging market and fragmented industry with solid backing from well-known institutions

Problem and Industry Background:

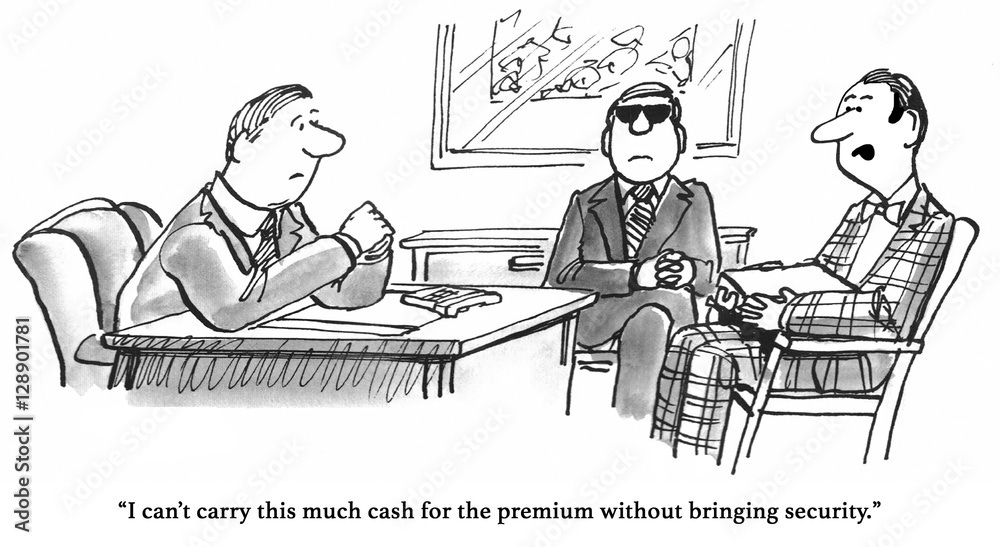

Source: FT Partners and QED Investors Presentation

In the past decade, an aging population, lifestyle factors, the integration of technology, and greater access to care through government policies have contributed to a rise in healthcare spending in the U.S. According to the CMS, U.S. healthcare spending as a share of the nation’s GDP stood at 17.7% as of 2019, compared to the nominal increase since 2010 of $1.2T. Consequently, payers have increased premium costs, shifting more of the financial burden directly to the patient. The U.S. healthcare system isn’t accustomed to this rise of consumerism, resulting in many cost and time inefficiencies within the billings and collections process which traditionally used to be a one-way street among providers and payers. Add in the rise of digitization to record and manage the plethora of patient data, and we have the perfect recipe for providers or payers to take advantage of these inefficiencies through fraud or abuse. For example, a provider may overcharge a payor for services it never performed, or a payor may falsely file claims to the government for patients who are dead. Enter Codoxo, which provides cutting-edge artificial intelligence solutions to assist payers and agencies in identifying fraud and abuse to control their costs.

Product Overview:

Source: Codoxo Website

Alongside its re-branding in December, Codoxo revealed its main product, the Codoxo Healthcare Integrity Suite. The product is comprised of six applications which utilize behavior-based analysis, problem detection, and prescriptive insights at the core of its forensic artificial intelligence engine. Notice how well the applications address issues with the patient treatment, billing, and claim processes.

Insight Scope:

The first component of the Healthcare Integrity Suite is Insight Scope, akin to a set of data analytics tools which democratize access to claim, provider, facility, and member insights. Companies can employ queries and filter through patient and provider reports, assign risk and integrity scores to providers, and even set up collaborative workflows within the organization to identify and monitor ongoing suspicious behavior. Insight Scope provides employees with a faster way to sift through piles of healthcare data, allowing them to reduce the amount of time they focus on finding the data as compared to analyzing any potential issues with it.

Network Scope:

Once the identification of a specific provider is done, the Network Scope tool is used to analyze its historical billing practices, claim lines, and medical code usage. These are a few of the insights a company can gain when negotiating contracts with providers to lower long-term costs and the information can also be aggregated into a dashboard for the company to compare across providers. This demonstrates how remarkable the data accessibility component of the platform is.

Provider Scope:

The third component of the Healthcare Integrity Suite delves into the billing side of the healthcare system. It differs from Network Scope because it allows for companies to continuously monitor, interact, and raise concern with provider billing practices. In a way, the tool gives the payer and provider with more opportunities to establish a symbiotic relationship moving forward.

Clinical Scope:

The next component of the Healthcare Integrity Suite focuses on accelerating prior authorization requests so patients aren’t prescribed unnecessary medicine or required to undergo unnecessary procedures. This is one of the best methods through which fraud and abuse can be uncovered, so both the payer and patient will save costs and time as Codoxo looks at historical provider behavior to flag any cases which it believes are concerning.

Payment Scope:

Before claims are paid to providers, Payment Scope allows pre-payment integrity teams to go through a claims dashboard breaking down claims by risk scores and savings. Suspicious claims can be identified before the payment to providers is made and both the review and payment process can be automated through Codoxo’s platform.

Fraud Scope:

The final component of Codoxo’s product is Fraud Scope, which automatically and accurately detects existing and emerging fraud schemes. Codoxo is able to detect fraud and abuse by integrating the information from the other five components, gather evidence chains for companies to back up the case, and offer employees clear scheme explanations. Employees start to understand how fraud cases originate and can adjust several features within Codoxo’s product as it fits their company’s process.

For a company founded only three years ago, Codoxo offers a very comprehensive and advanced product. Currently, the company primarily makes money through signed contracts and customer support, although any details about how it collects and records revenue is still unknown. As the issue of healthcare fraud gains more traction and more customers adopt the Healthcare Integrity Suite, look for Codoxo to expand its offerings, improve its technology, and further monetize several aspects of its platform.

Management:

Source: Codoxo Website

Codoxo is in its early innings as a company, which makes it even more important to evaluate whether leadership is experienced in the field, whether they have a strong vision for the company, and how they plan to achieve a path to profitability in the future. From my standpoint, it begins and ends with the CEO, and I am impressed with Musheer Ahmed’s background and passion for Codoxo. Ahmed founded Codoxo while pursuing his PhD at Georgia Tech and as a part of his dissertation. He built the entire platform which serves as a foundation for the Healthcare Integrity Suite today with the help of his professor and Codoxo’s Chief Scientist Mustaque Ahamad. Both individuals are extremely knowledgable and motivated to combat the issues in healthcare fraud they found while conducting their research. The combination of youth and experience between these two is also very appealing, and I believe Musheer’s technology background complements Mustaque’s prior experience in entrepreneurship and fraud management. I am confident Musheer will be able to evolve Codoxo’s product to compete with other companies in the industry and he has a great team to assist him in the process. You can find Musheer’s dissertation for more reference on his vision for Codoxo here and more information on the rest of the Codoxo team here.

Market Opportunity:

Similar to Codoxo, the global healthcare fraud analytics market is nascent. According to a research report published in January 2020, the total addressable market is projected to reach $4.6B by 2025 from $1.2B in 2020. Given the many issues the healthcare system faces due to fraud, it isn’t surprising to see how fast the market is projected to grow. However, it must be noted these projections are for the global market and Codoxo currently only operates in the U.S. Nevertheless, a growing market bodes well for Codoxo because it is a new player in a market which includes an established company, and fraud analytics companies focusing on other industries may look to make an entry. Matthew Risley, a partner at QED Investors and one of Codoxo’s investors, believes this isn’t a “winner take all” market, meaning Codoxo should still be able to succeed even if the competition strengthens.

Customers:

Presently, Codoxo primarily works with the largest healthcare providers and agencies in both the public and private sector. On its website, there are several examples and some testimonies by its customers such as Highmark and Harvard Pilgrim Healthcare. Providers mention how Codoxo’s artificial intelligence solutions catch new problems which the rules-based system would fail to do. Initially deployed only in certain parts of the billing payment and claims cycle, Highmark and Harvard Pilgrim Healthcare are now looking to expand the products use to all parts of the cycle. This should increase the expectation of prospective customers testing Codoxo’s platform, giving it a chance to impress them with its product on the road to building a longer-term relationship. To learn more about how Codoxo’s product is benefitting healthcare plans, a good reference is as follows here.

Competition:

Source: Cotiviti Website

As mentioned briefly above, Codoxo’s primary competitor is a well established company founded in 1979, Cotiviti. There are other players which compete with Codoxo, but they are either not directly focused on the fraud analytics market, or they are not operating in the healthcare space. Without diving too much into the details of Cotiviti’s operations, the company provides risk assessment and financial performance solutions in addition to the fraud and cost saving solutions Codoxo provides. Cotiviti also provides these solutions for the retail industry and was once a public company before it merged with Verscend to become a private company in 2018. Currently, Cotiviti has the clear advantage over smaller players like Codoxo due to its experience in the market and wider array of product offerings for customers. However, it does seem Cotiviti is more focused on ensuring greater financial efficiency for its customers is achieved through data analytics, whereas Codoxo is primarily focused on identifying cases which exhibit fraudulent characteristics.

A major reason why I believe Codoxo will be able to compete with Cotiviti in the future is because of their proprietary artificial intelligence platform. It is a priority of Codoxo to continuously iterate their platform, and unlike Cotiviti, its major selling point to customers will always be how its technology is superior relative to its peers. I don’t believe Cotiviti’s artificial intelligence platform is weak by any means, but its unclear to me how much its platform has evolved over the past 20 years, leading me to believe the newer algorithms and methods Codoxo uses may have an edge in quality.

Valuation/Fundraising/Investor Base:

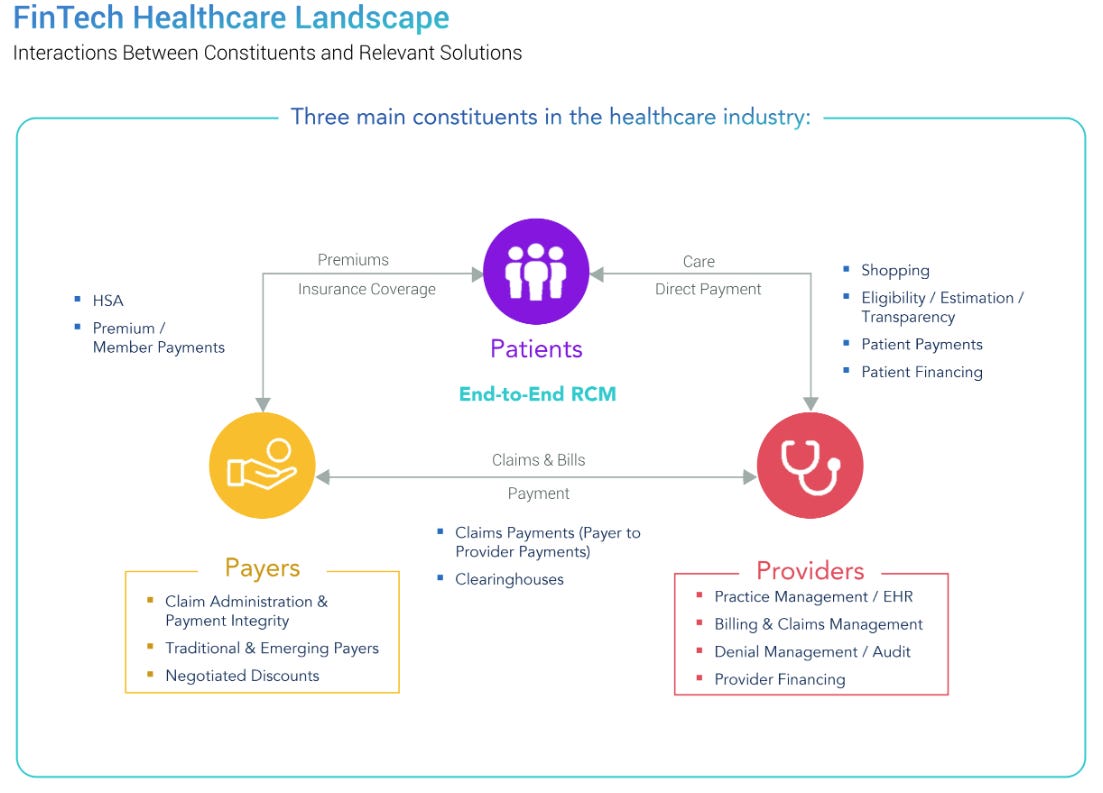

Source: FT Partners and QED Investors Presentation

One of the most important assessments to make when deciding whether an early-stage company has potential is to understand its existing investor base. It is very critical to determine whether those investors are experienced in the field and if they share a similar vision for the company as you. Above, you can find Codoxo’s fundraising information from the Seed to Series A stage. Immediately, the company’s consistent support from a concentrated group of investors stands out, signaling those investors still believe in the direction the company is heading in over the years.

Specifically, Spider Capital, Tech Square Labs, and Brewer Lane Ventures catch the eye as the few leading investors of Codoxo. Their focus, vast amount of experience in management and technology, and previous investment success strengthens the investment case for Codoxo. For example, Spider Capital is operated by seasoned executives who were instrumental in building companies such as Cisco, Salesforce, and Zoom. The leaders of Tech Square Labs were once successful entrepreneurs themselves who invested in well-known companies preparing for IPOs such as Coinbase and Lime. Brewer Lane Ventures is exclusively focused on investing in companies serving the Insurtech and Fintech space with Codoxo one of their eight investments. Through these investors, Codoxo has raised $9.4M in total with a post-money valuation in the range of $10M to $50M. Cotiviti was purchased by Verscend for $4.9B in 2018, illustrating the large difference in valuation between the two companies, but also demonstrating Codoxo’s future potential.

Conclusion:

Codoxo is in the early innings of a growing healthcare fraud analytics industry which exhibits a dire need for high-quality solutions. Its superior technology, strong leadership team, and solid investor base puts it in a great position to build its brand and compete with more established players in the industry. It’s biggest risk will be execution, but high remarks from its existing customer base signal a bright future lies ahead.

Disclaimer: Integrated provides company specific information regarding public and private companies in addition to weekly market commentary as part of our blog and emails. Such information is for general informational purposes only and should not be construed as investment advice or other professional advice. The cartoons included in the blogs are cited from other sources and not under the ownership of Integrated.